Is your money safe?

Promotional feature with Savings Champion

How to protect your savings and get a good return...

The financial crisis of 2007/8 made everyone think about their money - who they held it with and how safe it really was. As queues of people ran around the block of their local Northern Rock branches in late 2007, following reports that the provider was in trouble, suddenly it seemed that even our everyday savings held with our bank or building society could be wiped out if we didn’t make sure it was protected.

Luckily no one lost money with Northern Rock that day or indeed afterwards, but it definitely made people more safety conscious when it came to choosing where to save.

Fast forward to over 10 years later and we’re still suffering the effects of the financial crisis. Interest rates on savings accounts are still low by historical standards, but things are looking up. Best buy rates for savers are on the rise - which is good news as cash has, once again, become a safe haven for people who are concerned about stock market volatility and general Brexit uncertainty.

But it is important not to be complacent. Schemes are in place to ensure your money is fully protected and there are clever ways to ensure you’re getting a good return on your cash, whilst keeping your money safe.

What is the Financial Services Compensation Scheme (FSCS)?

The FSCS is a UK statutory fund that provides an insurance to savers if the worst happens and a provider goes bust.

The current limit is £85,000 per person, per banking licence.

For the majority, there is little concern as most people don’t hold more than £85,000 in savings - in fact it’s estimated that just 2% of the UK population does – so, if you’re one of those, you’re in the minority.

But if that is you, then you need to think hard about how comfortable you are if, should the worst happen, you lose any cash saved above the £85,000 limit.

How to improve returns and keep money protected

Don’t put all your eggs in one basket.

The first option is to open multiple savings accounts, spreading your money between a number of banks and building societies to ensure you don’t exceed the £85,000 limit with each.

You can choose which accounts you want from the whole savings market and ensure you don’t save more than £85,000 with each provider. But things are never as simple as that, as protection isn’t per provider but per banking licence.

A number of providers share a banking licence, so it’s easy to see how you might be under protected without even realising it. For example, Bank of Scotland shares its licence with Halifax, Birmingham Midshires, Saga and some old AA savings accounts - so any money in excess of £85,000 held in total with these brands is unprotected.

The good news is that currently most of the best rates aren’t with well-known providers but with the new ‘challenger banks’, which generally have their own single banking licence. But it’s still something to watch out for.

Introducing Cash Savings Platforms

Another option is to use the latest savings innovation in the form of a Cash Savings Platform.

These savings supermarkets offer you some great rates, with one simple application and login and therefore little hassle when you need to switch to the next best deal available on the platform.

But another big appeal is how they can make it easy to keep more of your money protected.

There are currently just a handful of Cash Savings Platforms available in the UK, with more coming to the market this year. Even well-known names such as Hargreaves Lansdown are getting in on the act.

What do they offer?

These platforms offer a range of savings products from a limited number of banks or building societies which you can choose from. The good news is that many of these savings platform providers offer some really competitive rates and some even offer market-leading rates from time to time.

How do Cash Savings Platforms work?

Once you’ve set yourself up on a platform, you can pick and choose which accounts you want to open from those that are available. You won’t be able to access the whole savings market, as you can if you do the legwork yourself, but it’s the simplicity of these platforms that is the key and the real appeal for most people using them.

With just one application and login, you’re free to move your money within the platform as and when you need to. They will let you know when your products are due to mature and you can choose where to move the money next. Even better, some platforms do this work for you.

All of the savings platforms make it easier to keep more of your money within the FSCS limits. Some don’t allow more than £85,000 to be saved in each account and others spread money between providers to minimise the risk, where possible. So, your money should be better protected.

Each platform is slightly different. Some only offer fixed term bonds, others have a larger range of account types. Some charge a small fee, whilst others receive a fee from the provider, so there is no explicit cost to you.

But for each platform, the premise is always the same, one simple login and you can improve the interest you earn but minimise the hassle of diversifying and switching – thereby keeping your money safer and working harder.

Want to find out more?

For more information on the platforms available, including who is offering them, how each one works and which one might be best for you, download the FREE guide to Cash Savings Platforms from Savings Champion.

This article is an advertorial

Celebrity news, beauty, fashion advice, and fascinating features, delivered straight to your inbox!

Sunil Makan is the Editor of British Marie Claire. With over 15 years of publishing experience, working on print publications and their digital counterparts, national newspapers and digital pure plays he is an Editor, Strategist, Content Producer, Creative Director and Brand Consultant.

Sunil’s specialisms include Fashion, Beauty and Grooming, Lifestyle and Culture. Prior to Marie Claire, Sunil worked at ELLE, InStyle and Shortlist Media and freelanced at various other titles.

-

Forget the Viral Triangle Scarf—Bandana-Print Scarves Are the Cooler Alternative

Forget the Viral Triangle Scarf—Bandana-Print Scarves Are the Cooler AlternativeChic, unexpected, and ideal while there’s still a chill in the air

-

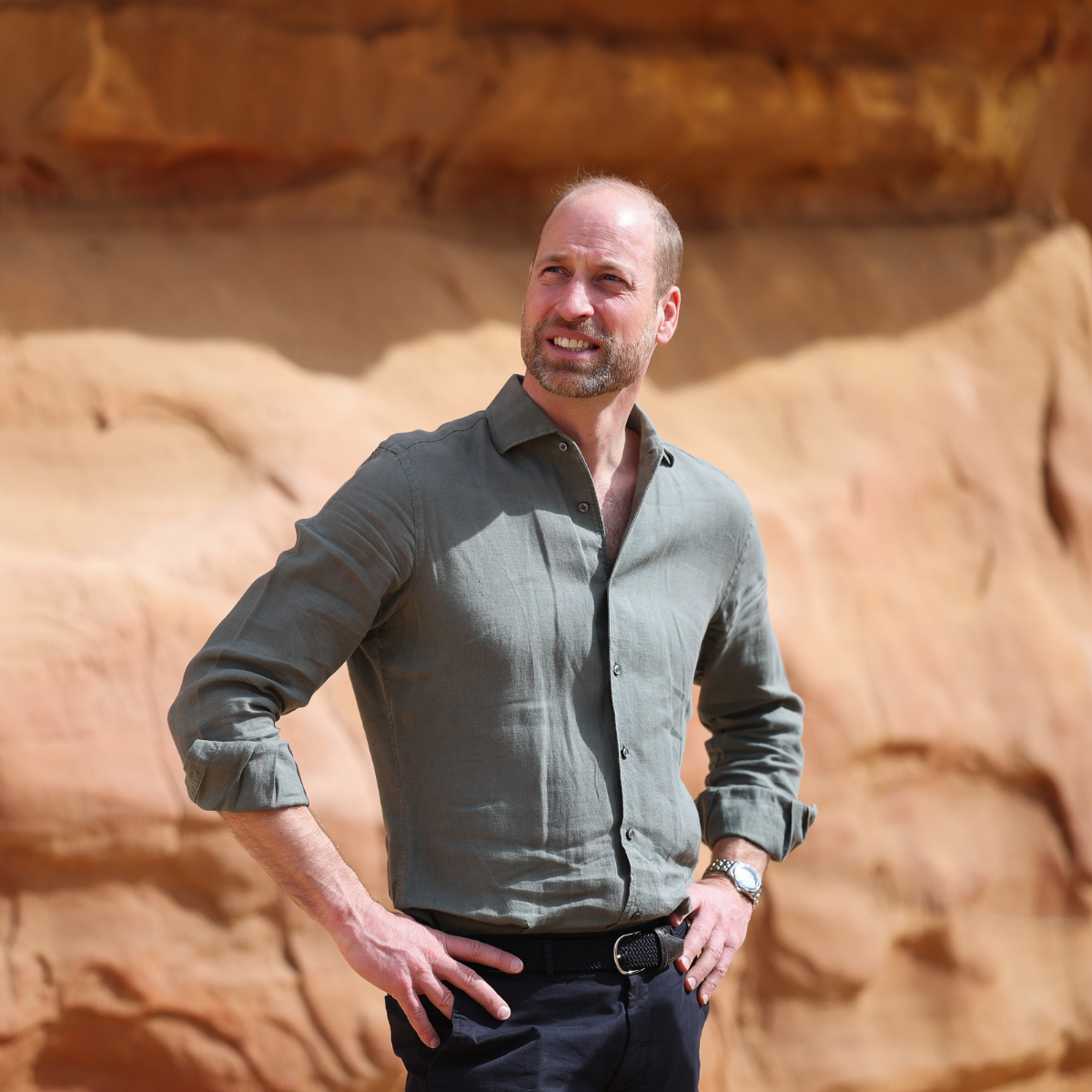

Prince William Shares Candid Admission About His Mental Health

Prince William Shares Candid Admission About His Mental HealthThe Prince of Wales opened up in a new interview

-

Are Magnesium Gummies Helpful or Overhyped? Top Experts Warn There’s a Problem No Ones Talking About

Are Magnesium Gummies Helpful or Overhyped? Top Experts Warn There’s a Problem No Ones Talking AboutBedtime bliss in a gummy? Not so fast.

-

How to manage skin changes during perimenopause and menopause, according to an expert

How to manage skin changes during perimenopause and menopause, according to an expertIn partnership with Vichy

-

5 easy ways to eat a more plant-based diet, according to chef Bettina Campolucci Bordi

5 easy ways to eat a more plant-based diet, according to chef Bettina Campolucci Bordi -

Give your home a new season glow-up with the latest autumn-winter collection from M&S

Give your home a new season glow-up with the latest autumn-winter collection from M&SPromotional feature with M&S

-

Here's how to maintain a pristine outdoor space

Here's how to maintain a pristine outdoor spaceIn partnership with Kärcher

-

5 eco-conscious questions to ask yourself before buying something new

5 eco-conscious questions to ask yourself before buying something new -

How I want to help elevate the profile of women in cycling

How I want to help elevate the profile of women in cyclingKeira McVitty on recovering from illness, YouTube and why cycling is a sport that keeps on giving

-

These are the key ways to go from passion to profit, straight from an expert

These are the key ways to go from passion to profit, straight from an expertIn partnership with GoDaddy

-

Why cycling is more than a hobby – it protects my family’s health

Why cycling is more than a hobby – it protects my family’s healthIn partnership with SKODA